Concentrate on Recovery Rather Than Your Finances

Download Brochure

The Sun Life insurance applications for Short-Term Disability, Long-Term Disability, Group Term Life, Accident Insurance, Hospital Indemnity Insurance, and Specified Disease Insurance, will be unavailable effective Friday, Feb. 20. due to system upgrades. The application forms are expected to be restored for your use, Monday, Feb. 23. Please check back on Monday for access to the forms utilizing the enroll button located under the How to Enroll section.

Specified Disease insurance helps to lessen the impact of unexpected costs you may experience by paying a lump-sum benefit so you can concentrate on recovery rather than your finances. Coverage pays benefits for the diagnosis and treatment of a specifically named disease or diseases, including critical illnesses and named conditions. Specified Disease insurance:

Helps protect your finances from an illness.

When you, your spouse/domestic partner, or child is diagnosed with a covered condition, you can receive a cash benefit to help pay unexpected costs not covered by your health plan.

Helps cover related expenses.

While health plans may cover direct costs associated with a specified disease, you can use your benefit to help with related expenses like lost income, child care, travel to and from treatment, deductibles, and co-pays.

Pays a cash benefit directly to you.

Specified Disease insurance can be used however you want, and it pays in addition to any other coverage you may already have. What’s more, all family members on your plan are eligible for the Wellness Screening Benefit, also paid directly to you once each year per covered person.

Key Features

- Covered conditions include but are not limited to heart attack, stroke, and cancer.

- You can purchase this coverage for you and your family.

- Child coverage is available to age 26.

Benefits

Eligibility

You may be eligible for Specified Disease insurance as an active, dues-paying member of PEF. You may also purchase this coverage for your family. Child coverage is available to age 26.

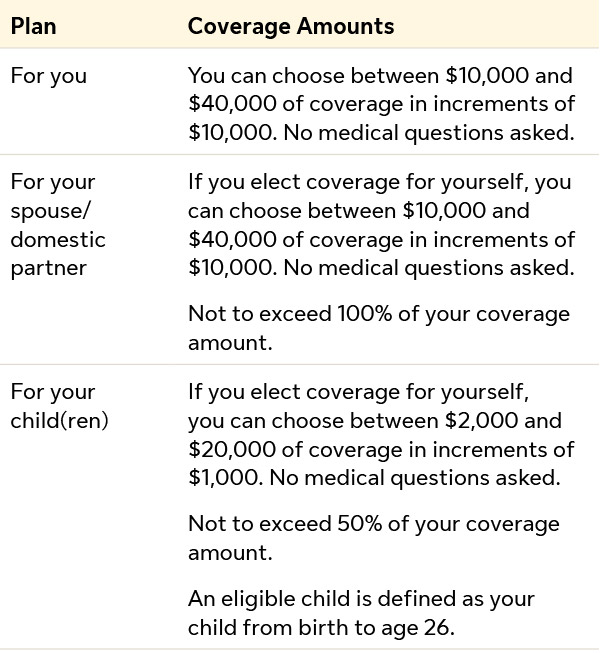

Coverage amounts

What’s Covered

Once your coverage goes into effect, you can file a claim for covered conditions diagnosed after your insurance plan’s effective date.

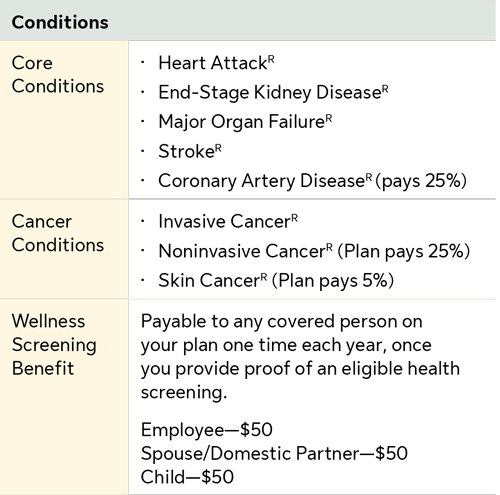

Covered conditions

The plan pays 100% of the benefit amount unless stated otherwise. The complete list of conditions includes:

R= Recurrence Benefit Available

When the Recurrence Benefit is needed

Sometimes people are diagnosed with the same condition more than once. If this happens to you, Sun Life will pay you for each time you are diagnosed for the conditions marked (R) in the table above.

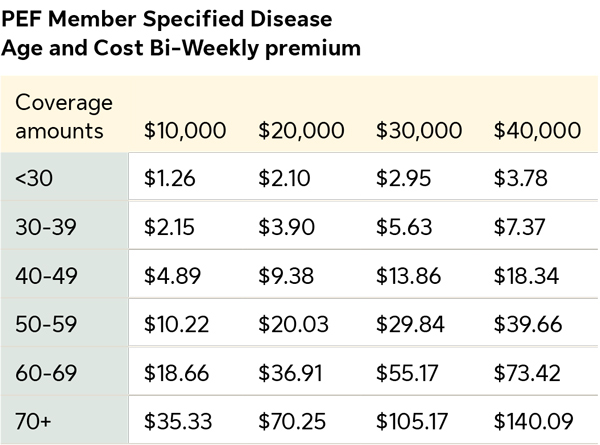

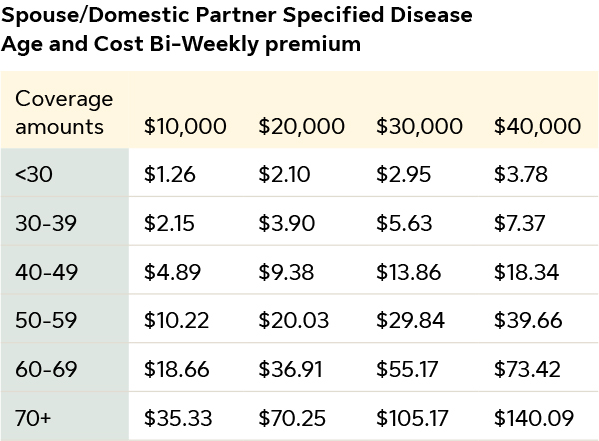

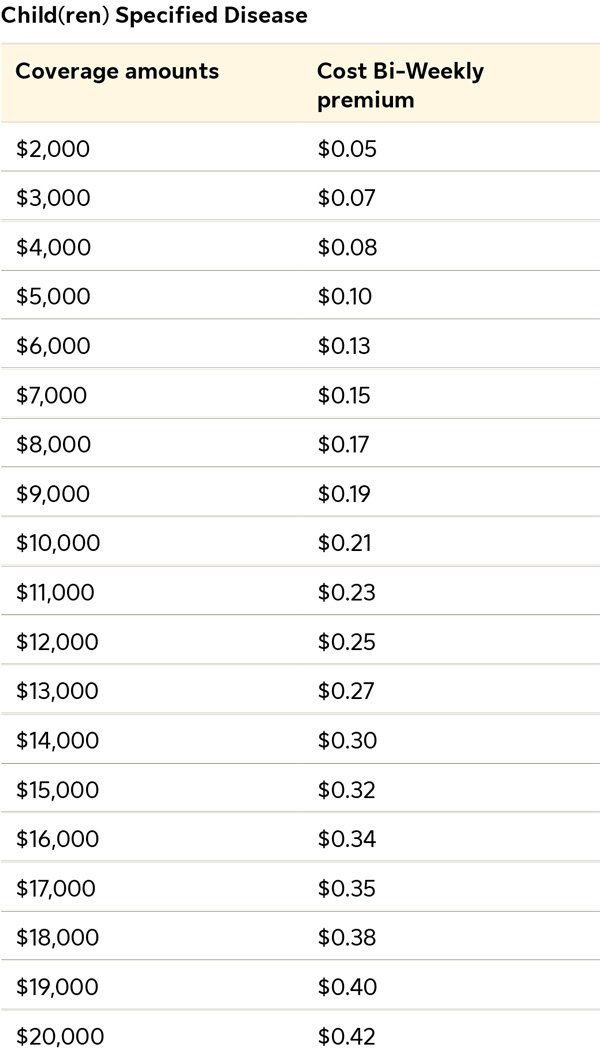

Rates

Total bi-weekly deductibles

Coverage and Bi-Weekly rates for Specified Disease Insurance.* Specified Disease coverage is contributory, meaning that you are responsible for paying for all or a portion of the cost through payroll deduction.

Find your age bracket (as of the effective date of coverage) to see the cost for the coverage amount you choose.

Covered conditions have specified diagnostic criteria that must be met (along with supporting documentation) for a benefit to be paid. For additional information regarding covered conditions, please request an outline of coverage.

Important Information

The following coverage(s) do NOT constitute comprehensive health insurance (often referred to as “major medical coverage”). They do NOT provide basic hospital, basic medical, or major medical insurance as defined by the New York State Department of Financial Services.

To become insured, you must meet the eligibility requirements set forth by PEF MBP. Your coverage effective date will be determined by the Policy and may be delayed if you are not actively at work on the date your coverage would otherwise go into effect. Similarly, dependent coverage, if offered, may be delayed if your dependents are in the hospital (except for newborns) on the date coverage would otherwise become effective. Refer to the Certificate for details.

Limitations and exclusions

The below limitations and exclusions may vary by state law and regulations. This list may not be comprehensive.

Please see the Certificate or call PEF MBP Insurance at (800) 767-1840 or (518) 785-1900, ext. 243, opt. 2.

Sun Life will not pay a benefit for any Specified Disease that is due to or results from: services or treatment provided by an immediate Family Member; suicide, attempted suicide or intentionally self-inflicted injuries; cosmetic surgery, except that cosmetic surgery shall not include reconstructive surgery when such service is incidental to or follows surgery resulting from trauma, infection or other diseases of the involved part, and reconstructive surgery because of congenital disease or anomaly of a covered Dependent Child which has resulted in a functional defect; service in the Armed Forces or units auxiliary thereto; war or any act of war (this does not include acts of terrorism); participation in a riot or insurrection; committing a felony or being engaged in an illegal occupation; your engagement in aviation and related activities, such as skydiving and parachuting, and participation as a professional in athletics or sports; being legally intoxicated or under the influence of any narcotic unless taken on the advice of a Physician and taken as prescribed.

How to Enroll

Enrolling in Specified Disease insurance is quick and easy with the online insurance enrollment form. You must have coverage for yourself before enrolling for coverage for a spouse/domestic partner, or child(ren). Spouse/domestic partner coverage cannot be higher than your own coverage amount. Please note the following:

You must join PEF before you can apply for any one or more insurances.

- If you have questions regarding Specified Disease insurance, existing coverage, or changes you are considering, please contact our office at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2, before enrolling.

- To access the online enrollment form, make sure you are signed into the website with your MIN. If you are not signed in, you will not see the insurance enrollment button below, that provides access to the online form.

- To enroll or to increase or decrease your coverage, please click the button below for access to the enrollment form.

- You will not be able to successfully submit your insurance enrollment form until all required fields (indicated by a red asterisk*) are completed.

- When your enrollment form is approved, your premiums will be automatically deducted from your paycheck.

PLEASE NOTE: The online enrollment form is not an acceptable way to cancel coverage. If you would like to cancel your insurance coverage, please contact PEF MBP at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2. You may also email PEF MBP Insurance.

Frequently Asked Questions

What if I have a pre-existing condition?

If your diagnosis is due to a pre-existing condition, benefits may not be payable if the diagnosis or treatment for your sickness was in:

- the first 6 months following your coverage effective date, or

- 6 months after any increase in your amount of coverage.

A pre-existing condition includes anything you have received treatment for in the 6 months prior to coverage becoming effective. Treatment can include consultation, advice, care, services, or a prescription for drugs or medicine.

Who do I call with questions about my claim?

If you have any questions regarding Specified Disease insurance or existing coverage, please contact PEF MBP Insurance at (800) 767-1840 or (518) 785-1900, ext. 243, opt. 2, before submitting a claim.

How do I get the Wellness Screening Benefit?

You may be paid the benefit when you or a covered family member submits proof of a covered screening each year, like specific blood tests, cancer screenings, cardiac stress tests, immunizations, school sports exams, and more.

Can I receive benefits for more than one Specified Disease?

Yes. In order to receive benefits for more than one Specified Disease, there must be at least six (6) consecutive months between each diagnosis date. You can only claim benefits once for each covered condition unless a recurrence benefit is payable.

Can I take my insurance with me if I leave my position with the State of New York?

If you leave your PEF position at the State, you cannot take your insurance with you.

PLEASE NOTE: Specified Disease insurance is a limited benefit policy. The Certificate has exclusions, limitations, and benefit waiting periods for certain conditions that may affect any benefits payable. Benefits payable are subject to all terms and conditions of your certificate.

Footnotes, Additional Details & Disclaimers

*What Are Your Odds of a Heart Attack? health.com, June 2018Sun Life companies include Sun Life and Health Insurance Company (U.S.) and Sun Life Assurance Company of Canada (collectively: “Sun Life”).

In New York Specified Disease insurance policies are underwritten by Sun Life and Health Insurance Company (U.S.) (Lansing, MI) under Policy Form Series 12-GP-SD-01, 13-SD-C-01, 15-GP-01, 15-GP-01, and 15-SD-GP-01.

© 2019 Sun Life Assurance Company of Canada, Wellesley Hills, MA 02481. All rights reserved. Sun Life and the globe symbol are trademarks of Sun Life Assurance Company of Canada. Visit Sun Life.

GVBH-EE-8348 SLPC 29579