Protect What You Love Most About Life. Your Family.

When it comes to protecting the financial security of your loved ones, nothing is more important than planning ahead. Group Term Life (GTL) insurance is a great way to provide your loved ones with financial protection when you can’t be there and when they need it most. Group Term Life insurance protects the life you love by securing it for the people most important to you. That is why the PEF Membership Benefits Program (PEF MBP) sponsors Group Term Life Insurance from Sun Life.

Why get GTL insuranceGroup Term Life Insurance Key Features

Eligibility

You may be eligible for Group Term Life as an active, dues-paying member of PEF. You may also be eligible for Dependent Life insurance coverage, if you are covered for Life Insurance under this plan, and you meet additional requirements.

How it works

Life insurance is not for you, it’s for those who must carry on without you should the unexpected happen. Do you have a spouse, children, or someone who depends on you for financial support? Do you have a spouse who works at home providing your family with such services as childcare, cooking, and cleaning (services that cost money to replace)? Are you single with parents or siblings who might be burdened by financial obligations should the unexpected happen to you? If so, you should consider life insurance. With Group Term Life insurance, your loved ones will receive a payment based on the coverage you have upon your death.

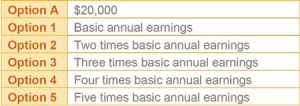

Coverage amount

As a PEF member, you have the opportunity to choose the coverage that best fits your needs. The following options are available:

- Your earnings are rounded to the next higher $1,000 (if not already a multiple of $1,000) based on your current earnings, up to a maximum of $600,000.

- If you are covered for Group Term Life insurance under this plan, you may also apply for dependent coverage for your spouse/domestic partner and dependent children. (Details below.)

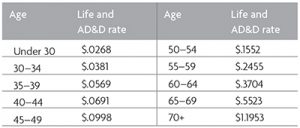

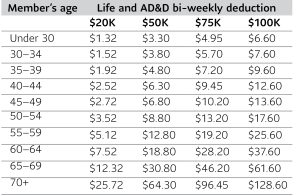

Cost of coverage for a PEF member

The cost for coverage is based on the amount of coverage you choose, your attained age, and a bi-weekly rate.

Bi-weekly rate per $1,000:

- Rates are adjusted as you enter a new age bracket.

- Rates and/or benefits may be changed on a class basis.

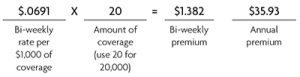

For example, a member aged 43 interested in $20,000 of coverage would pay:

If you have chosen a salary-based option and your annual earnings change for any reason, including a change due to a promotion to a PEF-represented position, your insurance will automatically be adjusted on the next available payroll.

Dependent Group Term Life insurance

Your Dependent Life insurance selection must represent your family status:

- Option D1 for married members/domestic partners

- Option D2 for unmarried members

Option D1—Dependent Life for married members/domestic partners

The spouse/domestic partner coverage amount cannot be more than 100% of your coverage amount. During the 240-day (from date of hire) new employee open enrollment, the only option available for spouse/domestic partner coverage is $20,000.

Domestic partner coverage

A “domestic partner” is an individual with whom you execute a domestic partner affidavit to establish eligibility. PEF MBP uses the same criteria currently used by the state of New York to qualify a domestic partner for health insurance benefits. You will have to show that you and your partner have been residing together for at least six months and you will need to provide documentation of financial interdependence such as a joint bank account, credit card, joint ownership of residence, or mutually granted durable power of attorney. This must be filed with and approved by PEF MBP prior to coverage becoming effective.

If you plan to elect Domestic Partner coverage, an additional form, the Domestic Partner Affidavit, must be completed and signed by a Notary Public and mailed to PEF MBP to prove partnership. This form is a supporting document to your insurance enrollment form. You may download and complete the form now.

Domestic Partner AffidavitIf you do not download it now to send to PEF MBP, a copy will be mailed to you by PEF MBP. This form must be completed and returned to prove partnership.

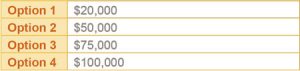

You can choose spouse/domestic partner coverage in the coverage amounts provided below:

Cost of coverage for a spouse/domestic partner

The cost for spouse/domestic partner coverage is based on the amount of coverage you choose, the member’s attained age, and a flat bi-weekly rate.

Option D2—Dependent Life for unmarried members

Your dependent children may be eligible for coverage if they are between 15 days and 19 years of age, or an unmarried child under the age of 25 who is enrolled as a full-time student, and depends on you for 50% of his or her support. Dependent Life insurance for your fully handicapped child can be continued past the age of 19. Please call PEF MBP for more information.

You may insure each eligible dependent child for $15,000 of life insurance coverage for 50 cents bi-weekly regardless of age or number of children.

Important points to consider

- If you apply when you are first eligible, you do not have to provide proof of good health.¹

- The coverage allows you to apply to receive a portion of your death benefit to help cover medical and living expenses if you become terminally ill.

- The policy includes an equal amount of AD&D (Accidental Death & Dismemberment) insurance, which provides a benefit if you or a covered dependent suffers a covered accidental injury or dies from a covered accident.

- Your cost depends on your age, the amount of insurance, and a bi-weekly flat premium rate that changes as you get older.

Retiree coverage

PEF members enrolled in the plan prior to retirement may maintain their Group Term Life insurance coverage as a member of the PEF Retirees. The AD&D benefit terminates upon retirement. Retirees are eligible to maintain Dependent coverage and are subject to coverage reductions defined under “coverage reductions”.

Coverage reductions

Benefits reduce to 60% of the amount in force on the first of the month following the month in which an active member attains age 70. If you are a retiree, and at age 70 you have participated in the plan for at least the five (5) continuous years preceding the attainment of age 70, and you are not an active member, your life insurance will be reduced to $20,000 or you may elect a further reduction in benefits to $10,000 or $5,000. If you have not been in the plan for five (5) continuous years, your coverage will terminate.

Exclusions

No Accidental Death & Dismemberment benefit will be payable for your loss that is due to or results from:

- suicide,

- intentionally self-inflicted injuries,

- sickness of any kind, or an infection unless due to an accidental cut or wound,

- mental or nervous disorder,

- your participation in a felony,

- your active participation in a war (declared or undeclared) or your active duty in any armed service during a time of war,

- your active participation in a riot or insurrection,

- injury or sickness sustained from any aviation activities, other than your riding as a fare-paying passenger on a scheduled or charter flight operated by a scheduled airline, or

- your being intoxicated or under the influence of any narcotic unless administered on the advice of a physician.

Additional Group Term Life Insurance Features

Accelerated Benefit

Should you or your spouse/domestic partner become diagnosed as terminally ill with a 12-month-or-less life expectancy, this benefit allows an accelerated payment of a portion of the terminally ill person’s life insurance proceeds. Your request cannot exceed 80% of the in force amount of life insurance and is subject to a minimum of the greatest of:

- 25% of the in force amount of life insurance,

- $10,000 if amount of insurance is less than $200,000,

- $50,000 if amount of insurance is $200,000+, and

- the Accelerated Benefit percentage originally selected, multiplied by the amount of life insurance that would have been in force for you, including any age reductions, at your expected time of death, up to a maximum of $600,000.

For your spouse/domestic partner, your request cannot exceed 80% of the in force amount of life insurance and is subject to a minimum of $2,500, up to a maximum of $100,000.

Should you or your spouse/domestic partner, if covered under this plan, become terminally ill, the funds are paid directly to you, or at your request, to your spouse/domestic partner with no policy restrictions on how they may be used. The remaining benefit is then payable to the beneficiary.

An individual or his or her spouse/domestic partner is said to be “terminally ill” if the person has a sickness or physical condition that is certified by a physician to reasonably be expected to result in death within 12 months.

Receipt of Accelerated Benefits may be taxable; you should seek assistance from your personal tax advisor for more information. Receipt of Accelerated Benefits may affect your eligibility for public assistance programs.Accidental Death & Dismemberment benefit

If you have elected Group Term Life insurance coverage for yourself or your dependents, you and your dependents are automatically covered for Accidental Death and Dismemberment (AD&D) coverage.

Accidental Death coverage

Accidental Death coverage provides an additional benefit equal to the amount of your life insurance coverage and is payable if your death occurs as a direct result of a covered accidental bodily injury sustained while insured, provided death occurs within 365 days of the accident.

Accidental Dismemberment coverage2

This plan pays a benefit if, while insured, you suffer a covered bodily injury caused by an accident and if, within 365 days after the accident, you lose, as a direct result of the injury, a hand, foot, or eye. The amount payable for any one loss is equal to one half the amount of your Accidental Death benefit. You may also be eligible for benefits ranging from 25% to 100% of your Accidental Death benefit for accidental losses that result in paraplegia, quadriplegia, or hemiplegia. However, no more than an amount equal to your full life insurance coverage is payable for all covered losses resulting from one accident.

- Loss of limb means severance of the hand or foot at or above the wrist or ankle joint.

- Loss of sight, speech, or hearing must be total and irrecoverable.

- Loss of thumb and index finger means severance through or above the metacarpophalangeal joints.

- Quadriplegia means the total and permanent paralysis of both upper and lower limbs.

- Paraplegia means the total and permanent paralysis of both lower limbs.

- Hemiplegia means the total and permanent paralysis of the upper and lower limbs on one side of the body.

Enhancements to your AD&D benefit

If you are eligible for a payment under the AD&D benefit, you may be eligible for one or more of the following enhancements:

- Child Care benefit–payable for each dependent if the dependent is younger than age 13 at the time of your death and if you provide proof of the dependent’s enrollment in a licensed child care program.

- Dependent Child Education benefit–payable to each of your dependents who qualify as a student.

- Spouse/Domestic Partner Education benefit–You may insure your spouse or domestic partner for a single lump sum for the lesser of expenses or $5,000 for employment training within one year of your death.

- Seat Belt benefit–if you die in a motor vehicle accident, the seat belt benefit may be paid in addition to the accidental death benefit.

- Air Bag benefit–is payable if a Seat Belt benefit is payable and you were in a seat protected by a supplemental restraining system that inflated on impact.

- Common Carrier benefit–if you die while traveling as a fare-paying passenger on a common carrier, a Common Carrier benefit may be payable in an amount equal to your Accidental Death benefit.

- Bereavement Counseling benefit–if an Accidental Death benefit is payable, Bereavement Counseling benefits up to $250 per immediate family member, up to a maximum of $1,000 per family, are payable during the 12 months following your death.

- Disappearance benefit–Sun Life will presume, subject to no objective evidence to the contrary, that you are dead and death is a result of an Accidental Bodily injury if:

- You disappear as a result of an accidental wrecking, sinking, or disappearance of a conveyance in which you were known to be a passenger, and

- Your body is not found within 365 days after the date of the conveyance’s disappearance.

How to Apply or Increase Existing Coverage Online

Applying for insurance for the first time, or increasing your existing coverage is quick and easy with the online insurance application. The application is automatically programmed to allow you to apply for the levels for which you qualify, whether you are applying for the first time or you are increasing your current coverage. Please note the following:

For new employees on the job less than 240 days

If you are a new employee (on the job less than 240 days) in the PS&T (Professional, Scientific & Technical) unit, you may apply with no medical questions asked¹. If we do not receive your insurance application(s) within 240 days of your date of hire with the PS&T unit, you can still apply in the insurances, but you will also need to complete a Evidence of Insurability (EOI) form.

Current employees (on the job more than 240 days) in the PS&T unit

If on the job more than 240 days, you may apply or increase coverage in an existing insurance, but you must complete an Evidence of Insurability (EOI) form along with your insurance application.

You must join PEF before you can apply in any one or more insurances.

Begin your application, increase, or decrease your existing coverage

- If you have questions regarding Group Term Life insurance, existing coverage, or changes you are considering, please contact our office at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2, before submitting an application.

- To access the online insurance application, make sure you are signed into the website with your MIN. If you are not signed in, you will not see the insurance application button below, that provides access to the online form.

- To apply in any of the insurances, or to increase or decrease your coverage in an existing insurance, please click the button below for access to the application.

- You will not be able to successfully submit your insurance application until all required fields (indicated by a red asterisk *) are completed.

Remember, if you have been on the job for more then 240 days and you are applying for the first time, or if you are increasing your existing Group Term Life insurance coverage, you must complete an Evidence of Insurability (EOI) form as well.

PLEASE NOTE: The online insurance application is not an acceptable way to cancel coverage. If you would like to cancel your insurance coverage, please contact PEF MBP at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2. You may also email PEF MBP Insurance.

When an Evidence of Insurability Form (EOI) is Needed

- If you did not apply for insurance in your first 240 days of employment with the PS&T unit.

- If you are increasing coverage on an existing insurance policy.

- If a PEF MBP representative requests that you complete an EOI form.

For more information: Call PEF MBP at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2. You may also email PEF MBP.

Beneficiary Form

When enrolling in Group Term Life insurance, you should designate your beneficiaries, the person(s) or entity that will receive the money from your policy’s death benefit when you pass away. The listing of beneficiaries allows assets to pass directly to whomever you designate, bypassing the costs and time involved with the probate process. Beneficiary designations do not have to be family members. They can be neighbors, siblings, close friends, even institutions, or charities.

• Review your designations on an annual basis.

• Know that you can change your beneficiaries at any time.

• Keep your beneficiaries up to date because your beneficiaries on your Group Term Life insurance plan, trump your will and trust plan.

To designate your beneficiary(ies), or to change your beneficiary(ies) on file with the PEF MBP for your Group Term Life insurance, please download the Change of Beneficiary Designation form below and return it to:

PEF Membership Benefits Program

10 Airline Drive, Suite 101

Albany, NY 12205

Footnotes, Additional Details & Disclaimers

Important: The above information is intended to provide an explanation of the general purposes of the insurance described, but it does not form a part of the group insurance policy. If any of the terms of the brochure or certificate differ from the group insurance policy, the policy will govern. Limitations and Exclusions apply. Please see the brochure for additional information.¹If the amount you apply for exceeds the Guaranteed Issue amount or if you decline coverage during your initial eligibility period and want to elect coverage or increase coverage at a later date, you are required to complete and submit an Evidence of Insurability application, which must be approved by Sun Life prior to coverage taking effect.

2Accidental Death & Dismemberment does not apply to retiree coverage. The AD&D benefit terminates upon retirement.

For NY consumers: Receipt of Accelerated Death Benefits may affect eligibility for public assistance programs and may be taxable.

This product web page is intended to provide an overview of the benefits available from the PEF Membership Benefits Program and is not a complete description of plan provisions. Review of this product web page does not certify eligibility for benefits under this plan. For complete plan details, including limitations and exclusions that may affect benefits, please refer to your certificate.

In New York, group life and disability insurance policies are underwritten by Sun Life and Health Insurance Company (U.S.) (Lansing, MI) under Policy Form Series 13-GP-LF-01, 13-LF-C-01, 13-GP-LH-01, 13-ADD-C-01, 13-LTD-C-01, 13-STD-C-01, 06P-NY-DBL, 07-NYSL REV 7-12, GP-A, GC-A, 12-LF-C-01, 12-GP-SD-01, 13-SD-C-01, 12-GP-01, 12-AC-C-01, 12-GPPort-01, 13-LFPort-C-01, 13-ADDPort-C-01, 12-STDPort-C-01, 12-LTD-P-01, 12-ACPort-C-01, and 13-SDPort-C-01.

©2022 Sun Life Assurance Company of Canada, Wellesley Hills, MA 02481. All rights reserved. Sun Life and the globe symbol are registered trademarks of Sun Life Assurance Company of Canada. Visit us at sunlife.com/us.

#1382799205 06/24 (exp. 06/26)