A Better Way to Afford the Care You Need

Hospital Indemnity insurance supplements your existing health insurance coverage by helping to pay for significant expenses that hospital stays often bring due to a covered accident or sickness. It’s flexible, meaning you can use it to help cover a variety of costs you might incur after you spend time in the hospital. For many people, hospitalizations can result in high out-of-pocket costs, sometimes in the thousands of dollars, depending on the length of stay.

Coverage pays a daily cash benefit directly to the member for an in-patient hospitalization up to 30 days, and offers an extended hospitalization benefit that provides additional coverage for stays over ten days, retroactive to the first day. The benefit is paid regardless of medical diagnosis or treatment, and can be used for anything from medical bills to groceries. Think about Hospital Indemnity insurance as a way to:

Help protect your finances.

When you are facing a hospital stay, you can receive a benefit to help pay unexpected expenses not covered by your existing health plan.

Help cover related expenses.

While health plans may cover direct costs associated with an illness or injury, you can use your Hospital Indemnity insurance to help cover expenses like lost income, child care, deductibles, and copays.

Receive a cash benefit paid directly to you.

Hospital Indemnity insurance payments can be used however you want, and it pays in addition to any other coverage you may already have. Benefits are paid directly to you.

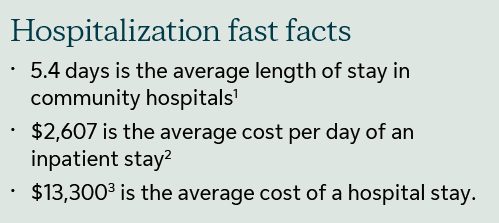

You may be asking yourself if you really need Hospital Indemnity insurance. Take into consideration these hospitalization fast facts:

Hospital Indemnity Insurance Key Features

Eligibility

You may be eligible for Hospital Indemnity insurance as an active, dues-paying member of PEF. You may also purchase this coverage for your family. Child coverage is available to age 26.

Coverage & coverage amounts

This plan offers hospitalization benefits for you, your spouse/domestic partner, and/or your child(ren). Child coverage is available to age 26. Enroll with no medical questions asked. Once your Hospital Indemnity coverage goes into effect, you can file a claim for hospital stays occurring after your plan’s effective date.

Benefits are payable for hospital stays due to:

- Sickness

- Accidents*

- Complications of pregnancy

- Newborn complications

- Routine newborn nursery care

- Mental and nervous disorders

- Substance abuse

*Confinements due to an accident must be within 365 days of the accident.

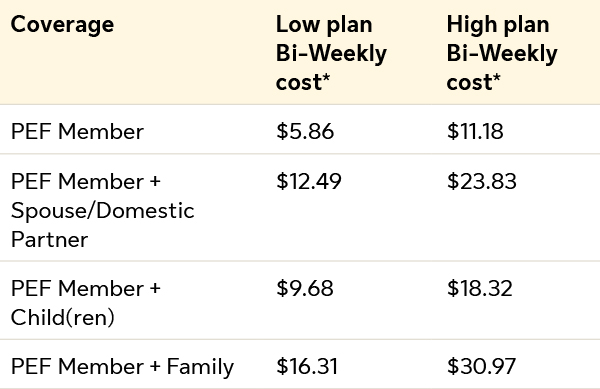

Total bi-weekly deductibles

Coverage and bi-weekly deductible amounts are effective January 1, 2024.

PLEASE NOTE: This is a limited benefit policy. It does NOT provide basic hospital, basic medical, or major medical insurance. It is not a Medicare Supplement policy. The Certificate has exclusions, limitations, and benefit waiting periods for certain conditions that may affect any benefits payable. Benefits payable are subject to all terms and conditions of the Certificate. The policy, Certificate, and any rider, if applicable, may not be available in all states and may vary based on state laws and regulations. This product is inappropriate for individuals who are eligible for Medicaid coverage.

To become insured, you must meet the eligibility requirements set forth by the PEF Membership Benefits Program. You must also be covered under major medical, or at least basic hospital and basic medical insurance. Your coverage effective date will be determined by the Policy and may be delayed if you are not actively at work on the date your coverage would otherwise go into effect. Similarly, dependent coverage, may be delayed if your dependents are in the hospital (except for newborns) on the date coverage would otherwise become effective. Refer to your Certificate for details.

Download BrochureHow to Enroll

Enrolling in Hospital Indemnity insurance is quick and easy with the online insurance enrollment form. You must have coverage for yourself before applying for coverage for a spouse/domestic partner, or child(ren). Spouse/domestic partner and child(ren) coverage cannot be higher then your own coverage amount. Please note the following:

You must join PEF before you can apply for any one or more insurances.

Enroll now or increase/decrease your existing coverage

- If you have questions regarding Hospital Indemnity insurance, existing coverage, or changes you are considering, please contact our office at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2, before enrolling.

- To access the online enrollment form, make sure you are signed into the website with your MIN. If you are not signed in, you will not see the insurance enrollment button below, that provides access to the online form.

- To enroll, or to increase or decrease your coverage, please click the button below for access to the enrollment form.

- You will not be able to successfully submit your enrollment form until all required fields (indicated by a red asterisk *) are completed.

- Once your enrollment form is approved, your premiums will automatically be deducted from your paycheck.

PLEASE NOTE: The online enrollment form is not an acceptable way to cancel coverage. If you would like to cancel your insurance coverage, please contact PEF MBP at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2. You may also email PEF MBP Insurance.

Frequently Asked Questions

Who do I call with questions about my claim?

If you have any questions regarding Hospital Indemnity insurance or existing coverage, please contact PEF MBP Insurance at (800) 767-1840 or (518) 785-1900, ext. 243, opt. 2, before submitting a claim application.

Do I need to file my claim within a certain timeframe?

You should file your claim within 30 days of a covered confinement or as soon as reasonably possible.

What if I have a pre-existing condition?

If your hospital stay is due to a pre-existing condition, benefits may not be payable if the diagnosis or treatment for your sickness was in:

- the first 12 months following your coverage effective date, or

- 12 months after any increase in your amount of coverage.

A pre-existing condition includes anything you have sought treatment for in the 3 months prior to coverage becoming effective. Treatment can include consultation, advice, care, services, or a prescription for drugs or medicine.

What benefits will I receive for my newborn child?

Benefits payable for your newborn child will depend on where their stay occurs. If your baby is receiving routine newborn nursery care, the regular hospital confinement benefits are payable. If your newborn stays in the Neonatal Intensive Care unit (NICU), the Intensive Care Unit (ICU) benefits will be paid.

Can I take my insurance with me if I leave my position with New York State?

If you leave your PEF position with the State, you cannot take your insurance with you.

Exclusions

Exclusions listed below may vary by state law and regulations. This list may not be comprehensive. Please see your Certificate for details or contact PEF MBP at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2. You may also email PEF MBP Insurance.

No benefits will be payable relating to or resulting from: services or treatment rendered or confinement outside the United States, Mexico, or Canada; any loss that is caused or contributed to by: war or any act of war; service in the Armed Forces or unit’s auxiliary thereof; participation in a felony; participation in a riot or insurrection; committing or attempting to commit suicide or intentionally self-inflicting injury; or cosmetic surgery except for reconstructive surgery or unless due to congenital anomaly or disease of a Dependent Child which has resulted in a defect; pregnancy or childbirth, except complications of pregnancy.

Footnotes, Additional Details & Disclaimers

1Trendwatch Chartbook 2020, American Hospital Association, 3.1 Average Length of Stay in Community Hospitals, 1995-2018. Chart Source: Analysis of American Hospital Association Annual Survey data, 2018 for community hospitals. Last accessed 07/21.21999–2019 AHA Annual Survey, Copyright 2020 by Health Forum, LLC, an affiliate of the American Hospital Association. Special data request, 2020. Last accessed 02/22.

3Consumer Health Ratings. Estimated cost for a hospital say in 2021 based on inflation. Last accessed 02/22.

Sun Life companies include Sun Life and Health Insurance Company (U.S.) and Sun Life Assurance Company of Canada (collectively: “Sun Life”).

In all states except New York, Group Hospital Indemnity insurance is underwritten by Sun Life Assurance Company of Canada (Wellesley Hills, MA) under Policy Form Series 15-GP-01, 20-HI-C-01, 12-GPPort-P-01, 20-HIPORT-C-01. In New York, Group Hospital Indemnity insurance is underwritten by Sun Life and Health Insurance Company (U.S.) (Lansing, MI) Under Policy Form Series 15-HI-GP-01, 20-HI-C-01, 12-GPPort-P-01, 20-HIPORT-C-01.

© 2022 Sun Life Assurance Company of Canada, Wellesley Hills, MA 02481. All rights reserved. Sun Life and the globe symbol are trademarks of Sun Life Assurance Company of Canada. Visit us at sunlife.com/us.

GVBH-EE-8384HI SLPC 30272

IMPORTANT: This is a fixed indemnity policy, NOT health insurance

This fixed indemnity policy may pay you a limited dollar amount if you’re sick or hospitalized. You’re still responsible for paying the cost of your care. The payment you get isn’t based on the size of your medical bill. There might be a limit on how much this policy will pay each year. This policy isn’t a substitute for comprehensive health insurance. Since this policy isn’t health insurance, it doesn’t have to include most Federal consumer protections that apply to health insurance.

Looking for comprehensive health insurance? Visit HealthCare.gov online or call 1-800-318-2596 (TTY: 1-855-889-4325) to find health coverage options. To find out if you can get health insurance through your job, or a family member’s job, contact the employer.

Questions about this policy? For questions or complaints about this policy, contact your State Department of Insurance. Find their number on the National Association of Insurance Commissioners’ website (naic.org) under “Insurance Departments.” If you have this policy through your job, or a family member’s job, contact the employer.