Extra Financial Support When an Unexpected Event Happens

Accident Insurance BrochureWhile accident insurance can’t stop accidents from happening, it can provide you with coverage for some of the costs that happen as a result of an accident. Think about accident insurance as a way to:

Help your finances after a mishap.

When you, your spouse/domestic partner, or child has a covered accident, like a fall from a bicycle that requires medical attention, you can receive cash benefits to help cover the unexpected costs.

Help cover related expenses.

While health plans may cover direct costs associated with an accident, you can use accident benefits to help cover related expenses like lost income, child care, deductibles, and co-pays.

Receive a cash benefit paid directly to you.

Accident insurance can be used however you want, and it pays in addition to any other coverage you may already have. Benefits are paid directly to you. And get this—there are no health questions or

pre-existing conditions limitations.

Key Features

- This coverage pays benefits whether your covered accident happens at work, at home, or away (also known as 24-hour coverage).

- You can purchase this coverage for you and your family.

- Child coverage is available to age 26.

What’s Covered

Eligibility

You may be eligible for Accident insurance as an active, dues-paying member of PEF. You may also purchase coverage for your family. Child coverage is available to age 26.

How it works

Once your coverage goes into effect, you can file a claim for covered incidents that occur after your insurance plan’s effective date. Unless otherwise specified, benefits are payable only once for each covered accident, as applicable.

Coverage & Coverage Amounts

For a complete list of what is covered and the coverage amounts, click the View Plan Coverages and Amounts link below, or download the full brochure.

Coverage amounts vary for covered incidents including:

- Dislocations

- Fractures

- Additional injuries

- Burns

- Lacerations

- Medical services

- Hospital

- Surgery

- Emergency dental

- Life and dismemberment losses*

*Benefits for life and dismemberment are for the PEF member only. Spousal/domestic partner benefits are 100% of the PEF member benefit amount for death and 100% of the PEF member benefit amount for dismemberment. Dependent children benefits are 50% of the PEF member benefit amount for death and 50% of the PEF member benefit amount for dismemberment.

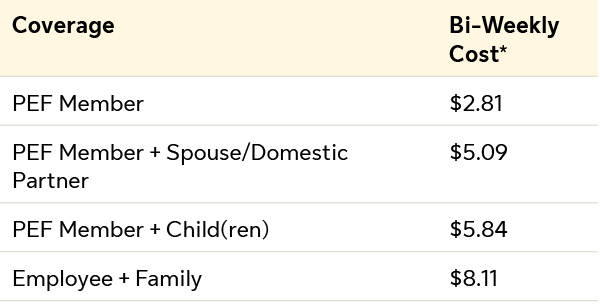

View Plan Coverages and AmountsRates

Total bi-weekly deductible

Accident coverage is contributory, meaning that you are responsible for paying for all or a part of the cost through payroll deduction.

Important information

The following coverage(s) do NOT constitute comprehensive health insurance (often referred to as “major medical coverage”). They do NOT provide basic hospital, basic medical, or major medical insurance as defined by the New York State Department of Financial Services.

This is accident only insurance. IMPORTANT NOTICE—THIS POLICY DOES NOT PROVIDE COVERAGE FOR SICKNESS.

To become insured, you must meet the eligibility requirements set forth by PEF MBP. Your coverage effective date will be determined by the Policy and may be delayed if you are not actively at work on the date your coverage would otherwise go into effect. Similarly, dependent coverage, if offered, may be delayed if your dependents are in the hospital (except for newborns) on the date coverage would otherwise become effective. Refer to your Certificate for details.

Limitations and exclusions

The below limitations and exclusions may vary by state law and regulations. This list may not be comprehensive.

Please see your Certificate or call PEF MBP Insurance at (800) 767-1840 or (518) 785-1900, ext. 243, opt. 2.

Sun Life will not pay an Accident benefit that is due to or results from: suicide while sane or insane; intentionally self-inflicted injuries; committing or attempting to commit an assault, felony or other criminal act; war or an act of war; active participation in a riot, rebellion or insurrection; voluntary use of any controlled substance/illegal drugs; operation of a motorized vehicle while intoxicated; if you do not submit proof of your loss as required by Sun Life (this covers medical examination, continuing care, death certificate, medical records, etc.); incarceration; engaging in hang-gliding, bungee jumping, parachuting, sail gliding, parasailing, parakiting or mountaineering; participating in or practicing for any semi-professional or professional competitive athletic contest in which any compensation is received, including coaching or officiating; injuries sustained from commercial air transportation other than riding as a fare paying passenger; work-related illness or injuries unless you are enrolled in 24-coverage.

How To Enroll

Enrolling in Accident insurance is quick and easy with the online insurance enrollment form. Please note the following:

You must join PEF before you can apply for any one or more insurances.

- If you have questions regarding Accident insurance or existing coverage, please contact our office at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2, before enrolling.

- To access the online insurance enrollment form, make sure you are signed into the website with your MIN. If you are not signed in, you will not see the insurance enrollment button below, that provides access to the online form.

- To enroll, please click the button below for access to the online form.

- You will not be able to successfully submit your enrollment form until all required fields (indicated by a red asterisk *) are completed.

- By enrolling, you authorize PEF MBP to make payroll deductions to cover the cost of your insurance premiums.

- When your enrollment form is approved, your premiums will be automatically deducted from your paycheck.

PLEASE NOTE: The online enrollment form is not an acceptable way to cancel coverage. If you would like to cancel your insurance coverage, please contact PEF MBP at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2. You may also email PEF MBP Insurance.

Frequently Asked Questions

Can I get accident coverage for myself and my family?

Coverage is available for the PEF member, PEF Member and Spouse/Domestic Partner, the PEF member and any number of children, and the PEF member and the entire family. The bi-weekly cost reflects the coverage chosen.

Who do I call with questions about my claim?

If you have any questions regarding Accident insurance or existing coverage, please call PEF MBP Insurance at (800) 767-1840 or (518) 785-1900, ext. 243, opt. 2, before submitting a claim.

What happens once my claim is approved?

The benefit amount you receive will depend on your injury and/or the treatment provided. Remember, benefits are payable only once for each covered accident, unless noted otherwise in the benefit schedule.

Is there a time schedule that I need to follow?

Injuries and other related benefits due to a covered accident must be diagnosed or treated within a defined period of time from the date of your accident. This could be as few as three (3) days for certain benefits. Please refer to your Certificate for details.

Can I take my insurance with me if I leave my position with New York State?

If you leave your PEF position with the State, you cannot take your insurance with you.

PLEASE NOTE: Accident insurance is a limited benefit policy. The Certificate has exclusions that may affect any benefits payable. Benefits payable are subject to all terms and conditions of your certificate.

Important Information Regarding Accident Insurance Coverage

Limitations & Exclusions

The below limitations and exclusions may vary by state law and regulations. This list may not be comprehensive.

Please see your Certificate or call PEF MBP Insurance at (800) 767-1840 or (518) 785-1900, ext. 243, opt. 2. You may also email PEF MBP Insurance.

Sun Life will not pay an Accident benefit that is due to or results from: suicide while sane or insane; intentionally self-inflicted injuries; committing or attempting to commit an assault, felony or other criminal act; war or an act of war; active participation in a riot, rebellion or insurrection; voluntary use of any controlled substance/illegal drugs; operation of a motorized vehicle while intoxicated; if you do not submit proof of your loss as required by Sun Life (this covers medical examination, continuing care, death certificate, medical records, etc.); incarceration; engaging in hang-gliding, bungee jumping, parachuting, sail gliding, parasailing, parakiting or mountaineering; participating in or practicing for any semi-professional or professional competitive athletic contest in which any compensation is received, including coaching or officiating; injuries sustained from commercial air transportation other than riding as a fare paying passenger; work-related illness or injuries unless you are enrolled in 24-coverage.

Footnotes, Additional Details & Disclaimers

In New York, group insurance policies are underwritten by Sun Life and Health Insurance Company (U.S.) (Lansing, MI) under Policy Form Series 15-GP-01, 16AC-C-01, 16-ACPort-C-01, 15-SD-GP-01, 16-SD-C-01, 16-SDPort-C-01, 15-HIGP-01, 20-HI-C-01, 20-HIPort-C-01.© 2025 Sun Life Assurance Company of Canada, Wellesley Hills, MA 02481. All rights reserved. The Sun Life name and logo are registered trademarks of Sun Life Assurance Company of Canada. Visit us at http://www.sunlife.com/us. SHMPBCH-2190-w

#1280417307 11/25 (exp. 08/26). Visit Sun Life.