Protect Your Paycheck & What You Love About Life

Long-Term Disability BrochureA serious illness or injury can turn your life upside down for months—or even longer—and it might, also, mean you aren’t able to work. If this happens, Long-Term Disability (LTD) insurance may give you the financial support you need so you can focus on getting better. Sun Life’s Long-Term Disability insurance, made available through the PEF Membership Benefits Program (PEF MBP), is available to help you return to work and your normal routine as quickly as possible.

In 2023, less than 2% of American workers missed work because of an occupational illness or injury.1 Most Long-Term disability claims are not due to an accident, nor do they happen at work. If the pandemic has taught us anything, it is that you need to plan for the unexpected and the chance you may become disabled. Many people are not prepared to manage the challenges that come with income loss due to a disability. Without disability insurance, many people must turn to their savings or change their lifestyle, should they experience a loss of income. Learn what the most common Long-Term Disability claims are and why you should have Long-Term Disability insurance.

Do you need insurance? Disability insurance for young adults Disability insurance for 30-40 year olds Disability insurance for adults over 40Long-Term Disability Insurance Features

Eligibility

You may be eligible for Long-Term Disability insurance as an active, dues-paying PEF member.

PLEASE NOTE: Restrictions apply for hourly members and per diem members are not eligible for coverage.

How it works

Long-Term Disability insurance provides you with a monthly benefit to help pay for everyday expenses (such as a mortgage, rent, utilities, childcare, or groceries), if a covered disability (e.g., back injuries or some chronic illnesses such as a heart attack, cancer, or stroke) takes you away from work for an extended time. You’ll continue to receive benefits until you’re able to return to work or until you reach the end of your benefit period. The definition of disability is the inability to engage in the material and substantial duties of your own occupation during the first two-and-a-half years that benefits are payable. Thereafter, disability is the inability to perform any occupation for which you are or can become qualified for with training, education, or experience.

If you become too sick to work, or an injury keeps you out of work, and you have a long term disability policy in place, you’ll submit a claim along with information about your condition from your doctor. If your claim is approved, you’ll start receiving the benefits determined by your plan as soon as the 6-month waiting period has passed. The money is paid to you directly, and there are no limitations on how it can be spent.

Coverage amount

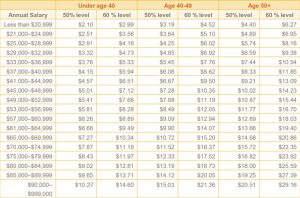

The Long-Term Disability plan offers two levels of coverage from which you can choose: 50% or 60% of your monthly income based on the salary on file at the time of disability, up to $7,500 per month. Your LTD benefit will be based on your monthly income, and it will not take into account earnings from investments or savings plans. Benefits must be reduced by other sources of income such as workers’ compensation, Social Security, disability pension, or other NYS retirement payments, etc. See your certificate for details.

Most common Long-Term Disability claims

- Musculoskeletal disorders affecting the bones, joints muscles, and connective tissues.

- Cancer

- Injuries such as fractures, sprains, and strains of muscles and ligaments

- Mental health issues

- Circulatory issues such as a heart attack or a stroke

Important points to consider

- Get a monthly check—after your claim is approved—that replaces 50% or 60% of your monthly income based on your salary on file at the time of disability, up to $7,500 a month, while you recover from a covered disability.

- Begin receiving benefits in as soon as six (6) months from the date you are unable to work. Receive a monthly benefit for up to the maximum benefit period or Social Security Normal Retirement Age if you are disabled before age 60—if you are still unable to work due to a covered disability. If you are disabled after age 60, you are eligible to receive a monthly benefit from one (1) year to five (5) years, depending on your age.

- No Long-Term Disability benefit will be payable to you for any disability that results from a pre-existing condition. A pre-existing condition is one for which you took medication or received treatment during the six (6) months before your effective date, or the effective date of an increase in your insurance. The exclusion applies only during the twelve (12) months (six (6) months for members age 65 and older) following your effective date.

- Qualify for additional benefits if your covered disability begins with a hospital stay of fourteen (14) days or more.

- Work with a certified rehabilitation specialist, when appropriate, to create a return-to-work plan that’s right for you.

- Provide your survivors with a lump sum benefit if your death occurs while you are eligible to receive a net monthly benefit and your total or partial disability has continued for 180 consecutive days.

- Choose the benefit amount that best meets your needs and your budget. Your cost depends on factors such as your age, monthly earnings, and the benefit amount you elect.

Available benefit amounts and costs based on a 26 bi-weekly pay period2

Exclusions

No Long-Term Disability benefit will be payable for any Total or Partial Disability that is due to:

- intentionally self-inflicted injuries,

- war declared or undeclared or any act of war,

- your active participation in a riot or insurrection, or

- your participation in a felony.

Why Choose Sun Life Long-Term Disability Insurance

Long-Term Disability insurance can be costly. The program benefit that the PEF MBP provides through Sun Life is a group policy, so the rates are generally less expensive than what you will find if you try to purchase a plan elsewhere. Medical expenses and job loss are two (2) of the most common reasons individuals file for bankruptcy.3 If you lost your income because you were injured or became too sick to work, would you be able to cover your living expenses, plus additional medical bills? For most people, the answer is no.

In addition, the PEF MBP’s Long-Term Disability insurance includes the following features:

- Retro Disability benefit–pays benefits retroactively to the first day of disability if you are hospitalized within 48 hours of disability, and then remain hospitalized continuously for fourteen (14) days or more, and remain totally disabled through the end of the Elimination Period.

- Survivor Income benefit–a three-month Survivor Income benefit that pays a lump sum equal to three (3) times your monthly benefit after Total or Partial Disability has continued for at least 180 consecutive days and while you are eligible to receive a monthly benefit.

- Residual Disability–you do not need to be Totally Disabled during the Elimination Period.

- Return-to-work benefit–pays a Return-to-Work benefit if you return to work on a part-time basis.

- Assisted Living benefit–pays an additional 20% of total monthly earnings or $5,000, whichever is less, if you are disabled and are also cognitively impaired or unable to perform two (2) or more activities of daily living.

- Rehabilitation benefit–pays a Rehabilitation benefit if you participate in a rehabilitation program approved by Sun Life.

To learn more about Long-Term Disability insurance, call PEF MBP at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2.

View Cristie’s Sun Life Story.

How to Apply or Increase Existing Coverage Online

Applying for insurance for the first time, or increasing your existing coverage is quick and easy with the online insurance application. The application is automatically programmed to allow you to apply for the levels for which you qualify, whether you are applying for the first time or you are increasing your current coverage. Please note the following:

For new employees on the job less than 240 days

If you are a new employee (on the job less than 240 days) in the Professional, Scientific & Technical (PS&T) unit, you may enroll with no medical questions asked3. If we do not receive your insurance application(s) within 240 days of your date of hire with the PS&T unit, you can still apply for the insurances at any time, but you will also need to complete an Evidence of Insurability (EOI) form.

Current employees (on the job more than 240 days) in the PS&T unit

If on the job more than 240 days, you may apply or increase coverage in an existing insurance, but you must complete and submit an Evidence of Insurability (EOI) form along with your insurance application, which must be approved by Sun Life prior to going into effect.

You must join PEF before you can apply in any one or more insurances.

Begin your application, increase, or decrease your existing coverage

- If you have questions regarding Long-Term Disability insurance, existing coverage, or changes you are considering, please contact our office at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2, before submitting an application.

- To access the online insurance application, make sure you are signed into the website with your MIN. If you are not signed in, you will not see the insurance application button below, that provides access to the online form.

- To apply for any of the insurances, or to increase or decrease your coverage in an existing insurance, please click the button below for access to the application.

- You will not be able to successfully submit your insurance application until all required fields (indicated by a red asterisk *) are completed.

Remember, if you have been on the job for more then 240 days and you are applying for the first time, or if you are increasing your existing Long-Term Disability insurance coverage, you must complete an Evidence of Insurability (EOI) form as well.

PLEASE NOTE: The online insurance application is not an acceptable way to cancel coverage. If you would like to cancel your insurance coverage, please contact PEF MBP at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2. You may also email PEF MBP Insurance.

When an Evidence of Insurability Form (EOI) is Needed

- If you did not elect insurance in your first 240 days of employment with the PS&T unit.

- If you are increasing existing coverage.

- If a PEF MBP representative requests that you complete an EOI form.

If you are downloading and completing the insurance enrollment application and the medical questionnaire, return both to:

10 Airline Drive, Suite 101

Albany, NY 12205

For more information: Call PEF MBP at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2. You may also email PEF MBP.

Footnotes, Additional Details & Disclaimers

1Bureau of Labor Statistics, 2023. “Employer-related workplace injuries and illnesses”2Keep in mind that other sources of income could impact your benefit amount. The rates shown above include the PEF Membership Benefits Program administrative fees.

3If you decline coverage during your initial eligibility period and want to elect coverage or increase coverage at a later date, you are required to complete and submit an Evidence of Insurability application, which must be approved by Sun Life prior to coverage taking effect. For additional information, contact the PEF Membership Benefits Program.

This product web page is intended to provide an overview of the benefits available from the PEF Membership Benefits Program and is not a complete description of plan provisions. Review of this product web page does not certify eligibility for benefits under this plan. For complete plan details, including limitations and exclusions that may affect benefits, please refer to your certificate.

This policy provides disability income insurance only. It does NOT provide basic hospital, basic medical, or major medical insurance as defined by the New York State Department of Financial Services. The expected benefit ratio for this policy is 75.8%. This ratio is the portion of future premiums that the company expects to return as benefits, when averaged over all people with this policy.

In New York, group insurance policies are underwritten by Sun Life and Health Insurance Company (U.S.) (Lansing, MI) under Policy Form Series 13-GP-LF-01, 13-LF-C-01, 13-GP-LH-01, 13-ADD-C-01, 13-LTD-C-01, 13-STD-C-01, 06P-NY-DBL, 07-NYSL REV 7-12, GP-A, GC-A, 12-GP-SD-01, 13-SD-C-01, 12-GP-01, 12-AC-C-01, 12-GPPort-01, 13-LFPort-C-01, 13-ADDPort-C-01, 12-STDPort-C-01, 12-ACPort-C-01 and 13-SDPort-C-01.

©2022 Sun Life Assurance Company of Canada, Wellesley Hills, MA 02481. All rights reserved. Sun Life and the globe symbol are registered trademarks of Sun Life Assurance Company of Canada. Visit us at sunlife.com/us.

#1378698505 06/24 (exp. 06/26)