Protect Your Paycheck & What You Love About Life

Short-Term Disability BrochureSurgery, having a baby, or even an illness or injury can keep you away from work. Your ability to earn a paycheck is your most valuable asset. Help protect it with Short-Term Disability* (STD) insurance, a benefit that works for you when you can’t, due to a covered disability. It’s an affordable way to continue receiving a steady income so you can focus on getting better. This insurance provides you with a weekly cash benefit to help pay for expenses (such as mortgage/rent, utilities, childcare, or groceries) without relying solely on vacation days, sick pay, or your savings to stay on track with your expenses. Medical expenses and job loss are the two most common reasons individuals file for bankruptcy.1 If you lost your income because you were injured or became too sick to work, would you be able to cover your living expenses, plus additional medical bills? For most people, the answer is no.

When it comes to protecting income, many people don’t make it a priority, but they should. Did you know, the biggest reason for not enrolling in Short-Term Disability insurance is the lack of a perceived need for it. It’s everyone’s belief that, “it’s not going to happen to me!” If the pandemic has taught us anything, it is that you need to plan for the unexpected and the chance you may become disabled. Your chance of acquiring a disability is higher than you probably think!

What about Paid Parental Leave (PPL)?

Paid Parental Leave provides eligible employees job-protected, paid time off (up to 12 weeks of fully paid leave without charge to accruals for parental leave completed within seven (7) months of the birth, adoption, or foster care placement of a child (“qualifying event”)).

Short-Term Disability insurance serves as a supplement to PPL for anyone who is having a baby. You must enroll in Short-Term Disability before becoming pregnant to benefit from the coverage. Combined with Paid Parental Leave, Short-Term Disability provides you and your family with extra cash to help you recover from the disability caused by childbirth and the costs associated with taking time to bond with a child.

Do you need insurance? Disability insurance for young adults Disability insurance for 30-40 year olds Disability insurance for adults over 40Short-Term Disability Insurance Features

Eligibility

All active, dues-paying members of the Public Employees Federation (PEF), actively working 35 hours, bi-weekly, in a PEF-represented position may be eligible under this group disability insurance plan. Certain restrictions will apply to part-time, per diem, or hourly members.

PLEASE NOTE: *NYS employees are not eligible for New York Disability Benefits Law coverage, therefore this insurance program may be of interest to you! Without this insurance, you may have to use your sick time, vacation time, or even put your paycheck at risk if you are out of work due to a Short-Term Disability.

How it works

You can buy affordable protection that may provide you with a weekly benefit once your claim is approved. This replacement income can help you manage your expenses without relying solely on vacation days, sick pay, or your savings to stay on track with your expenses. If you become too sick to work, or an injury keeps you out of work, and you have a Short-Term Disability policy in place, you’ll submit a claim along with information about your condition from your doctor. If your claim is approved, you’ll receive benefits, as long as you remain disabled according to the policy, until the end of the benefit period of 26 weeks. The money is paid to you directly, and there are no limitations on how it can be spent.

Important Fact: According to a May 2025 PEW Research Center article, 48% of Americans say they have rainy day funds that would cover their expenses for three (3) months in case of sickness, job loss, economic down turn, or other emergencies.1

The most common Short-Term Disability claims

- Pregnancies

- Musculoskeletal disorders affecting the bones, joints muscles, and connective tissues

- Injuries such as fractures, sprains, and strains of muscles and ligaments, as well as digestive disorders, and mental health issues including depression and anxiety

Coverage amount

Your STD plan, sponsored by PEF MBP, allows you to choose the benefit option that best fits your needs. Your STD benefit payments are not taxable when premium is paid by the employee with post-tax dollars.

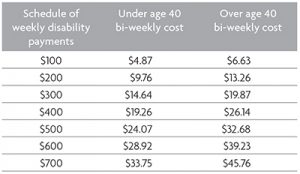

26-week plan rates

Important points to consider

- Get a weekly check—after your claim is approved—that replaces a portion of your income while you recover from a covered disability.

- Benefits are paid if you are absent from work while insured, as a result of either a job-related or non-job-related injury or illness. You must be under the care of a legally qualified physician. Disability benefits are payable for a covered disability on the first day for accidental bodily injury and on the eighth day for sickness.

- Benefits are not payable for disabilities caused by, contributed to by, or resulting from a pre-existing condition for the first twelve (12) months (six (6) months for members 65 and older) following the effective date of insurance or an increase in insurance. A pre-existing condition is one for which an insured has received medical treatment, consultation, care, or services, including diagnostic measures or prescribed drugs or medicine, within the three (3) months prior to his or her effective date of insurance or increase in insurance. Please refer to your certificate for additional details.

- Receive a weekly check for up to 26 weeks—as long as you are still unable to work due to a covered disability.

- Provide your survivors with a lump sum benefit if your death occurs while you are eligible to receive a net monthly benefit and your Total or Partial Disability has continued for fourteen (14) consecutive days.

Exclusions

No Short-Term Disability benefit is payable for any Total Disability that is due to:

- intentionally self-inflicted injuries,

- a war, declared or undeclared, or any act of war,

- your active participation in a riot or insurrection,

- or your participation in a felony.

Termination

Your insurance will terminate on the earliest of:

- the date the Group insurance Policy terminates,

- the date the Group insurance Policy no longer insures your class,

- the date the premium payment is due, but not paid by the PEF Membership Benefits Program,

- the date on which you cease to be in an eligible class, including:

- temporary layoff,

- leave of absence, including but not limited to leave for military service, or

- the date your PEF membership ceases, or

- the date you retire.

To learn more about Short-Term Disability insurance, call PEF MBP at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2.

View Cristie’s Sun Life story.

How to Apply or Increase Existing Coverage Online

Applying for insurance for the first time, or increasing your existing coverage is quick and easy with the online insurance application. The application is automatically programmed to allow you to apply for the levels for which you qualify, whether you are applying for the first time or you are increasing your current coverage. The effective date of your coverage depends on the date you enroll and whether proof of good health is required. Please note the following:

For new employees on the job less than 240 days

Your application for disability insurance coverage will automatically be approved if you enroll within 240 days of the first date of hire in a Professional, Scientific & Technical (PS&T) unit position (first date of eligibility to become a PEF member), up to the $400 level.2 Coverage that does not require proof of good health will begin the day your enrollment form is received by PEF MBP.

Current employees (on the job more than 240 days) in the PS&T unit

If you do not enroll within the 240-day period, or if you elect the $500, $600, or $700 levels, you will have to complete and submit an Evidence of Insurability application, which must be approved by Sun Life before coverage can begin.

If you’re absent from work due to injury or illness on the date coverage would normally begin, your insurance coverage will become effective on the date you actually return to work on a full-time basis.

You must join PEF before you can apply in any one or more insurances.

Begin your application, increase, or decrease your existing coverage

- If you have questions regarding Short-Term Disability insurance, existing coverage, or changes you are considering, please contact our office at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2, before submitting an application.

- To access the online insurance application, make sure you are signed into the website with your MIN. If you are not signed in, you will not see the insurance application button below, that provides access to the online form.

- To apply for any of the insurances, or to increase or decrease your coverage in an existing insurance, please click the button below for access to the application.

- You will not be able to successfully submit your insurance application until all required fields (indicated by a red asterisk *) are completed.

Remember, if you have been on the job for more than 240 days and you are applying for the first time, or if you are increasing your existing Short-Term Disability insurance coverage, you must complete an Evidence of Insurability (EOI) form as well.

PLEASE NOTE: The online insurance application is not an acceptable way to cancel coverage. If you would like to cancel your insurance coverage, please contact PEF MBP at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2. You may also email PEF MBP Insurance.

When an Evidence of Insurability Form (EOI) is Needed

- If you did not elect insurance in your first 240 days of employment with the PS&T unit.

- If you are increasing existing coverage.

- If a PEF MBP representative requests that you complete an EOI form.

If you are downloading and completing the insurance enrollment application and the medical questionnaire, return both to PEF MBP at:

10 Airline Drive, Suite 101

Albany, NY 12205

For more information: Call PEF MBP at (800) 767-1840, or (518) 785-1900, ext. 243, opt. 2. You may also email PEF MBP.

Footnotes, Additional Details & Disclaimers

1 Pew Research Center, May 7, 2025, “Growing share of U.S. adults say their personal finances will be worse a year from now”2If you decline coverage during your initial eligibility period and want to elect coverage or increase coverage at a later date, you are required to complete and submit an Evidence of Insurability application, which must be approved by Sun Life prior to coverage taking effect. For additional information, contact the PEF Membership Benefits Program.

The rates shown above include the PEF Membership Benefits Program Administrative Fees.

This product web page is intended to provide an overview of the benefits available from the PEF Membership Benefits Program and is not a complete description of plan provisions. Review of this product web page does not certify eligibility for benefits under this plan. For complete plan details, including limitations and exclusions that may affect benefits, please refer to your certificate.

This policy provides disability income insurance only. It does NOT provide basic hospital, basic medical, or major medical insurance as defined by the New York State Department of Financial Services.

In New York, group insurance policies are underwritten by Sun Life and Health Insurance Company (U.S.) (Lansing, MI) under Policy Form Series 12-DI-C-01, 16-DI-C-01, 15-GP-01, 13-GP-LH-01, 13-LTD-C-01, 13-STD-C-01, 06P-NY-DBL, 12-GPPort-01, and 12-STDPort-C-01.

The Sun Life name and logo are registered trademarks of Sun Life Assurance Company of Canada. Visit us at sunlife.com/us.

#1382790836 02/26 (exp. 02/28)

NAWC-11125-3